Discount Rate Modelling

Risk and Return

risk /rɪsk/

a situation involving exposure to danger, from Italian risco “danger”

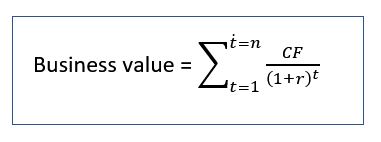

Business value is a function of expected cash flows and the risk attached to those cash flows. The value of a business is the present value of future cash flows discounted back to a value today.

A discount rate is used to discount back future cash flows to a value today. The discount rate reflects the risk and the rate of return required by investors and financiers to compensate them for that risk.

Discount rate

Companies raise finance from a variety of sources which are either equity-based, debt based or a hybrid of the two. A company’s cost of capital is the combined rate of the return required by equity holders and debt holders.

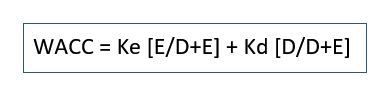

The business valuer can calculate a company’s cost of capital by weighting the equity and debt returns according to the respective amounts of equity and debt. This is known as the Weighted Average Cost of Capital (WACC) and is calculated using the equation below. Where Ke is the cost of equity, Kd the cost of debt, E the value of equity and D the value of debt. The cost of debt is the after-tax cost of debt.

Risk-free investments

Typically, the least risky investments are treasury bonds. The government guarantees you will get your money back.

The key risk would be if the government got into difficulty and defaulted on the debt. Treasury bonds in stable countries are low risk. Consequently, the annual rate of return on a treasury bond is low. The current German ten-year bond yield (the annual return) is negative. As an investor, you have to pay to keep your money invested in the government; it is so safe!

The more unstable the country and the government, the higher the return required. The current South African ten-year bond yield is 0%. Investing in South Africa is perceived as riskier than investing in Germany.

The current Australian ten-year bond rate is 2.63%; this is an indicator of a “risk-free” rate.

Cost of debt

The cost of debt to a company reflects the default risk. Default risk is the perceived risk that the company may be unable to repay interest and or debt repayments. The more debt the business has relative to equity and the less cash it generates to cover interest payments, the higher the default risk and the higher the cost of debt.

Cost of equity

Equity investment represents both a threat and opportunity. There is the opportunity for equity investors to receive a return above the expected return, but a threat that it will be less.

The cost of equity reflects the risks investors perceive in expected earnings and their ability to diversify some of that risk. Equity risk incorporates market risk and firm-specific risk. The more volatile cash flows, the higher the risk and the higher the return required.

Value formula

The value of a business can calculate by using the discounted cash flow formula below. Where n is the period of cash flows, for example, the business may have a life of ten years, n=10, CF is the periodical cash flow, and r is the firm’s cost of capital.

Simon is a CA Business Valuation specialist in Brisbane, Chartered Accountant and a Certified Fraud Examiner. Simon specialises in providing business valuation services. Prior to founding Lotus Amity, he was a Corporate Finance and Forensic Accounting partner with BDO Australia. Simon provides valuation services in disputes, for raising finance, for restructuring, transactions and for tax purposes.