CAPM

The Capital Asset Pricing Model (CAPM) is the financial model that is most often referred to when calculating risk and return.

CAPM assumes that there are no transaction costs, investments are infinitely divisible, investors can invest in all assets and that all investors have access to the same information. Consequently, under the model, rational investors will hold a market portfolio consisting of all listed investments to eliminate exposure to firm-specific risk.

Under the model, investors can reduce their overall risk exposure by investing in a risk-free investment, ie. a government treasury bond. The overall risk exposure is determined by the percentage invested in risk-free investments and the percentage in a market portfolio.

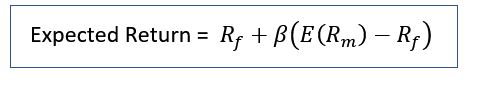

CAPM formula

Under CAPM the expected return of an investment is equal to the return that can be generated from a risk-free asset, plus a premium to reflect the risk of investing in a market portfolio, the Equity Risk Premium.

The extent of the impact of the equity risk premium is determined by how much the investment moves with the overall market. This movement with the market is called beta. The beta measures the covariance of the assets returns with the market, divided by the variance of the market’s return.

Simon is a CA Business Valuation specialist, Chartered Accountant and a Certified Fraud Examiner. Simon specialises in providing valuation services. Prior to founding Lotus Amity, he was a Corporate Finance and Forensic Accounting partner with BDO Australia. Simon provides valuation services in disputes, for raising finance, for restructuring, transactions and for tax purposes.