Veterinary practice valuation

Important inputs in veterinary practice valuations include revenue, revenue growth and margins. According to the Australian Tax Office, in 2021 veterinary practices with a turnover of more than $800,000 earnt an average gross profit margin of between 74% and 77% and an average net profit margin of 20%.

A key component in veterinary practice valuations is determining a market salary for the owner practitioner(s). This is particularly relevant when valuing a smaller veterinary practice, where adjusting for a market salary may eliminate any profits available to an investor. Owner compensation is a key issue in court cases, see Corbon & Klousner (2015) and Scott & Scott (2006). Adjustments also need to be made for any spouse or children working in the clinic who are not paid a market salary.

When analysing expenses and profit margins, adjustments need to be made for expenses with related parties which are not at market rates, for example, if the property is owned by the practitioner and not rented to the clinic at a commercial rate.

Another key consideration can be determining the extent that the client relationships reside with the practitioner. Does the goodwill reside with the veterinary practice or with the practitioner? How transferable is the goodwill?

Other factors that can impact veterinary practice valuations include location, the practice type such as equine versus small-animal, additional revenue sources such as grooming and pet food, competition, equipment, systems in place, demographics and the stability and availability of staff.

Veterinary M&A consolidation activity

Certain large or listed entities consolidate or “roll up” veterinary practices to reduce back-office costs and obtain synergies.

Large and or listed companies typically have a lower cost of capital and offer cost savings, so the value of the clinic to a large or listed acquirer could be worth more than to an individual investor and so the institutional investors may be prepared to a higher price.

Apiam Animal Health Limited

According to the May 2022 acquisition strategy of ASX-listed Apiam Animal Health Limited (AHX), Apiam plans to double revenue to $300 million by 2024 through a combination of acquisition and organic growth.

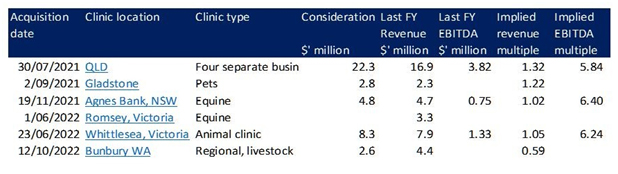

Since its initial public offering in 2015, Apiam has made twenty acquisitions, with the number of acquisitions increasing in the last twelve months. The figure below summarises recent Apiam acquisitions, per the company’s ASX announcements.

The above Apiam acquisitions appear to typically comprise of between 70.0% and 85.0% cash with the balance in Apiam shares and a small dollar amount deferred. 50.0% of shares are usually escrowed for a minimum of 12 months with the remainder escrowed for a minimum of 24 months.

Other veterinary practice acquirors

Other significant Australian veterinary practice acquirors include:

- Greencross Vets (acquired by private equity firm TPG) with approximately 160 clinics

- Vet Partners (formerly National Veterinary Care Ltd which was acquired by US-owned Vet Partners) with approximately 300 clinics within Australia and New Zealand

Significant acquirors based in Europe and North America include:

- global leader IVC Evidensia (formerly Independent Vetcare Ltd) owned by Swedish-based private equity firm EQT AB; the company operates from 2,600 clinics in 20 countries

- CVC Group PLC operated 500 clinics in the UK, Netherlands, and Republic of Ireland

- Pets at home group PLC operates 453 UK clinics on a joint venture basis

- VCA (formerly Veterinary Centers of America) operates 1,000 clinics in North America, owned by Mars Inc

- private equity backed Thrive Pet Healthcare (formerly Pathway Veterinary Alliance) with approximately 400 clinics in the US

- VetCor owned by Harvest Partners and recent acquirer of People, Pets & Vets, with approximately 600 clinics in the US

Observed M&A multiples

Observed consolidator acquisition EBIT multiples over the last ten years range between approximately 3.0 and 5.5 and revenue multiples between 0.7 and 2.0.

Multiples, however, need to be used with caution, higher multiples can reflect higher earnings growth expectations or specific acquisition terms, for example, earn-out clauses, and the percentage of scrip versus cash and escrow restrictions.

The application of observed multiples needs to be consistent with the earnings base of the subject practice. For example, observed multiples may be implied against earnings in the last financial year, in the last twelve months or expected earnings in the next twelve months.

Wilde & Wilde – family court matter

In the Family Court of Australia case of Wilde & Wilde [2007] FAMCA 1044, one of the issues in the matter of the appeal was whether the judge erred in the value determination of the husband’s veterinary practice in relation to the valuation method adopted and the use of comparable sales and analysis. The experts took different approaches to valuing the veterinary practice (para. 128).

The husband’s expert adopted a capitalisation of future maintainable earnings approach which the trial judge recorded as “conventional and well known to the Court” (para. 141). The wife’s expert adopted a hybrid method of valuing the practice by using comparable sales together with an analysis of the actual performance (para. 139).

The husband’s expert consolidated the earnings of the veterinary practice and arrived at an after-tax future maintainable profit of $35,000 to which the expert applied a capitalisation rate of between 22.5% and 25.0% (para. 129).

The wife’s expert compared the profit of the husband’s veterinary practice to veterinary practices in a database compiled by the expert (para. 135). The expert observed that the earnings as a percentage of gross fees were below the average for veterinary practices (para. 136, 359). As a consequence, the expert concluded that the income of the business should be higher and adjusted income accordingly (para. 136, 360). The expert then applied a 31.0% capitalisation rate (para. 136, 361).

The appeal referred to Lonergan’s text: The Valuation of Businesses, Shares and Other Equity 24 to 25 (para. 167):

“it is generally inappropriate to value on the basis that the new owner is able to achieve full synergistic and other improvements.”, “many willing but not anxious buyers acquire businesses, or equity in the structures that the businesses are conducted in, with a view to improving their performance. Therefore, there would be no gain to be made in the acquisition if the purchaser paid away to the vendor as part of the purchase price the capital value of the expected profit improvements.”

No error was found in the appeal. In essence, the husband’s expert approach was upheld.

Veterinary valuation engagements

Lotus Amity provides veterinary practice valuations. Past veterinary practice valuation engagements have included:

- The valuation of the equity in a group of veterinary clinics, the report was prepared for the ATO to establish if shareholders were eligible for scrip for scrip roll-over relief under Subdivision 124-M of the Income Tax Assessment Act.

- Consulting services in relation to understand and interpreting the factors that may influence the sales price of a regional small animal, bird and pocket pet practice

To find out more about the Lotus Amity valuation process click here.