What is a business valuation?

What is a business valuation? What inputs are required and what judgements and assumptions need to be made? Is business valuation a science or an art?

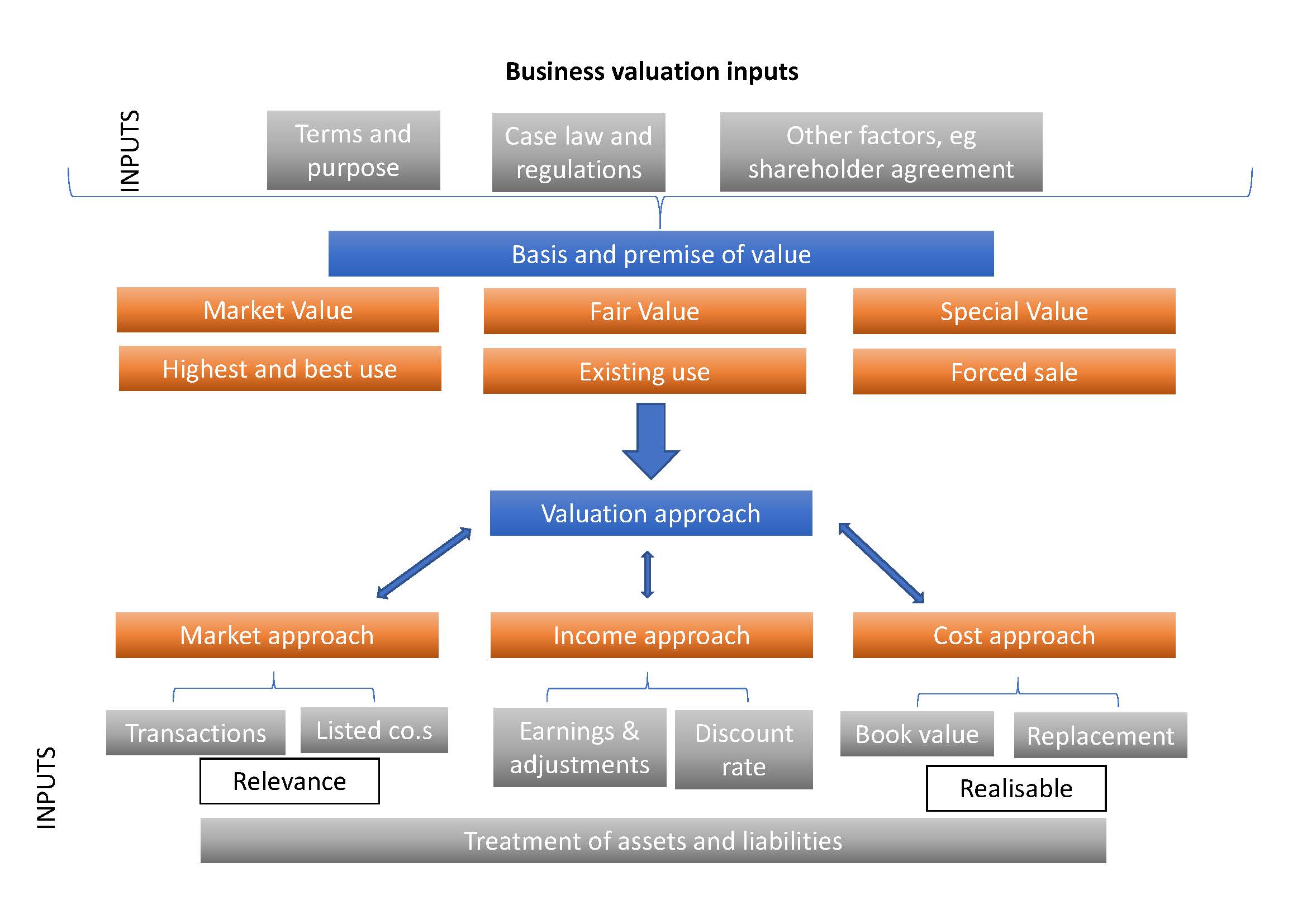

Business valuation inputs

The chart below illustrates some of the key aspects inputs to a business valuation. Starting from the top, the business valuer first considers the purposes of the valuation, relevant case law and regulations and any other relevant factors, such as a shareholder agreement that stipulates how a business is to be valued.

Having considered these inputs, the business valuer then selects the appropriate definition of value, the basis of value, for example, Market Value, Fair Value or Special Value, such as Investment Value or Synergy Value. The basis of value will determine the business valuation outcome. The valuer further needs to consider the premise of value, such valuing the business in its highest and best use, existing use or under a forced sale.

Having considered the basis and premise of value the valuer then selects an appropriate valuation approach: the Market Approach, Income Approach or Cost Approach. With each approach are a number of methods, the business valuer selects the appropriate method. The approach and method that is selected will depend on the basis and premise of value, but also the financial inputs, such as the availability of relevant market transactions, future earnings and risk and the liquidity of assets.

Business valuation as a science

Business valuation adhere to well-established approaches: the market, income or cost approach. Within each approach is a range of methods, for example, within an income approach the valuer may adopt a discounted cash flow method or a capitalisation of earnings method.

Some of the methods rely on mathematical formulae and financial models, for example, in the discounted cash flow method a capital asset pricing model may be used to calculate the cost of equity. The valuer has to analyse the financial information, prepare valuation metrics and consider relevant academic research.

For these reasons, some argue business valuation is a science.

Business valuation as an art

The problem is the output from the valuation methods depends on the inputs and those inputs are not clear. Judgement is required. Judgement about the relevance of market information. Judgements about the future earnings and the risk attached to those earnings. Judgements about the realisable value of assets and debt. Judgement is also required about the appropriate basis and premise of value and the most suitable valuation approach and method.

The business valuer has to make assumptions. Assumptions about how the business is going to perform in the future, what is going to happen in the industry and in the economy. Assumptions about the reliability of financial information, the relevance of agreements and past case law.

For these reasons, some argue business valuation is more art than science.

Business valuation as a craft

The sagacious Professor Aswath Damodaran argues business valuation is neither a science nor an art. In science the laws of physics and mathematics are universal. In art, there is a magic which you either have or you don’t.

The Professor proposes instead that business valuation is instead a craft. A skill you learn by doing and the more you do you better you get!

Simon is a CA Business Valuation specialist in Brisbane, Chartered Accountant and a Certified Fraud Examiner. Simon specialises in providing valuation services. Prior to founding Lotus Amity, he was a Corporate Finance and Forensic Accounting partner with BDO Australia. Simon provides valuation services in disputes, for raising finance, for restructuring, transactions and for tax purposes.